Islamic car loan interest rates The profit rate on Islamic car loans is a bit higher on average than the interest rate on regular car loans. 5000 will be taken.

How To Start A Used Car Dealership A Definitive Guide Upflip

Historical Data View and export this data back to 1987.

:max_bytes(150000):strip_icc()/Just-what-factors-value-your-used-car_round2-debecdd740064e55b77979a734920925.png)

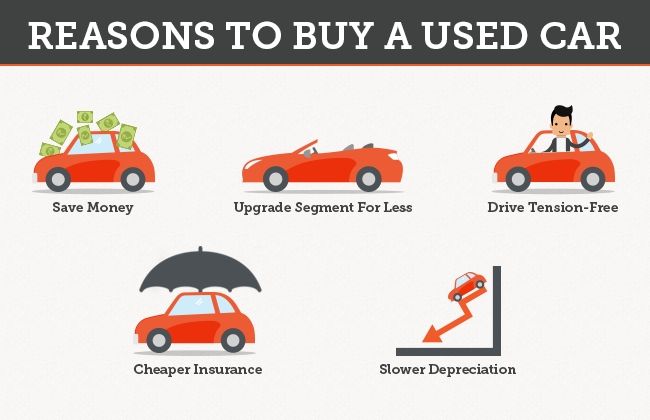

. Generate principal interest and balance loan repayment chart over loan period. Hong Leong Islamic Auto Financing-i. Depreciation rates and insurance costs are lower for a used car when compared to a new car.

Principal amount Interest charges RM50000 RM13750 RM63750. With a flat interest rate the amount of interest you pay is fixed upon the principal. When you take a 9-year loan for RM 100000 at the current 25 percent interest rate - the typical during this bearish RMCO period - youre paying RM 22500 in interest alone.

The cheapest non-Islamic car loan is the BSN Hire Purchase with an interest rate of 28 while the most expensive non-Islamic car loan is the Maybank My First Car Loan with an interest rate of 34. Loan interest rate will be different depends on the risk of the borrower the term of the loan the amount of the loan etc. Using the rest rate method of calculation the interest you pay is based on the principal the original loan amount of RM84000 every month.

This should be one of the most affordable rates that you can get in the country. Compare auto loan rates in May 2022. Enter down payment amount in Malaysian Ringgit.

Their website has limited information about their car loan packages so youll have to contact a branch nearest to you. Inter-State NOC Refundable Security Deposit non-interest bearing of Rs. Enter car loan period in Years.

14 June 2019 Bank Negara Malaysia Above information is for reference only. The HDFC Bank Pre-Owned Car Loan Rates Fees are as follows. You can save on the interest rate payment by reducing the repayment period or lowering the margin of finance.

Hong Leong Auto Loan Interest Rate 324 pa. The interest rate of the car loan will be affected by the type of car sports carfamily car loan amount loan tenure and your credit history. It will be the borrowers responsibility to provide the transferred Registration Certificate to the bank.

Use our car loan calculator to find the financing deal that best suits your budget. 349 to 949 with autopay 36 to 84 months. In addition NOC charge would be Rs.

Down payment and interest rates A minimum of 10 down payment is usually required by banks for the purchase of a brand-new car and about 20 for a used car. Tenure over 5 years Monthly Repayment RM581. Edmunds data reveals that 218 of shoppers who financed.

Enter car price in Malaysian Ringgit. Generate principal interest and balance loan repayment table by year. Thats enough to buy a youngtimer Bavarian classic as a weekend fun car with balance left for maintenance work.

Used Car Loan Interest Rates Used Car Loan Interest Comparison Table Used Car Loan Features and Benefits Flexible repayment terms are offered by certain lenders. Comes in the forms of percentage an interest rate is calculated on an annual basis. The annual percentage rate APR on new financed vehicles averaged 55 in November compared to 57 in October and 6 in November of 2018.

Most banks will offer a competitive car loan interest rate around 2-6 pa depending on the type of car new or used national or foreign. The documentation process is simple and minimum paperwork needs to be submitted. The average auto loan interest rate is 386 for new cars and 821 for used cars according to Experians State of the Automotive Finance Market.

Kindly check with the bank to know the exact interest rate. For loan periods that are five years or less Carsome customers are eligible to get super low rates depending on their loan amount which are 099 for RM30000 to RM40000 199 for RM40001 to RM50000 and 219 for RM50001 and above while six to seven years are at 268 and eight to nine years are at 288. For example say the loan amount is RM84000 and the interest rate you pay is 34 per annum for 7 years.

Share it with your family and friends who want to buy house in 2019. If you plan on getting a fixed rate hire purchase loan a 7-year repayment plan will generally have a 320 interest rate and an RM525 monthly rate. Enter loan interest rate in Percentage.

For loan periods that are five years or less Carsome customers are eligible to get super low rates depending on their loan amount which are 099 for RM30000 to RM40000 199 for RM40001 to RM50000 and 219 for RM50001 and above while six to seven years are at 268 and eight to nine years are at 288. These used car loans from Malaysias banks have been created to make it easier for you to get behind the wheel and get motoring. The average new-car interest rate was 407 and used-car rates averaged 862 in the first quarter of 2022 according to Experian.

:max_bytes(150000):strip_icc()/Just-what-factors-value-your-used-car_round2-debecdd740064e55b77979a734920925.png)

Just What Factors Into The Value Of Your Used Car

5 Reasons Why You Should Buy A Used Car Business Standard News

Average Used Car Insurance Rates By Vehicle Insure Com

Used Cars And Trucks Command High Prices High Demand Low Supply

25 Things You Should Always Do Before Buying A Used Car Gobankingrates

Can You Finance A Used Car And Should You Moneyunder30

How To Buy A Used Car Credit Karma

What To Expect In The 2022 Used Car Market

Wholesale Auction Prices For Used Cars Trucks Up Almost 50 Vs Pre Pandemic

What To Expect In The 2022 Used Car Market

Report Interest Rates On Auto Loans Will Decline Further In 2021 Kelley Blue Book

Buying A Used Car In Mexico As A Foreigner Hippie In Heels

What To Expect In The 2022 Used Car Market

Best Car Rental In India Car Rental Car Rental Company Car Rental Service

Can A 10 Year Old Used Car Still Be Reliable Autotrader

Some Relief On Affordability Used Car Prices Still High But Trending Lower

Used Vehicle Pricing Hits Bizarre Levels

What S The Oldest Used Car You Should Consider Autotrader

Germany Used Car Market Research Research Report Overview Application Segmentation Value Forecast Future Outlook Scope And Trends